Guest Post – Tradition Mortgage’s Weekly Update September 19, 2016

Markets Waiting in Limbo For Fed News

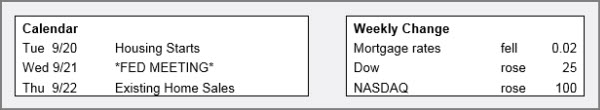

Market volatility continues to increase as the debate rages on regarding the plans for an impending Fed rate increase. Adding fuel to the fire, the rate picture has been further obscured by two big offsetting reports from last week.

Helping the case for no hike, retail sales fell 0.3% from July. Excluding the volatile auto component, retail sales also fell far short of the expected levels with a small decline from July. After a strong start, Retail Sales have slowed again during the last two months, though, leaving investors and Fed officials wondering what future data will reveal.

Making the opposite case for an immediate rate hike, the Consumer Price Index (CPI), a widely followed monthly inflation report, revealed higher than expected levels of overall inflation and core inflation. CPI looks at the price change for goods and services which are sold to consumers. Core CPI excludes the volatile food and energy components, which provides a better sense of the underlying trend. Core inflation in August was 2.3% higher than a year ago, up from a 2.2% annual rate last month.

These offsetting influences caused little net change in investor expectations for future Fed policy. The odds makers are still betting on no rate hike this time, but stay tuned……….

Week Ahead

Factors: The main event this week will be Wednesday’s Fed meeting. The Fed statement and press conference often cause a large reaction in financial markets..

Volatility: Moderate

Trend: Neutral

This information is intended for professional reference only, and not intended for consumer use. Additional qualifications and disclosures apply.

Have a great day!

Jim Krantz

Vice President

NMLS # 761955

Jim.Krantz@TraditionLLC.com

Direct 952.252.4488 / Cell 612.716.9999 / Fax 952.252.4489