Time is on our side. Time continues to be on the side of potential homebuyers, as home loan rates remain near 18-month lows. But could a hint of inflation be creeping into our economy—and if so, could higher home loan rates be on the horizon?

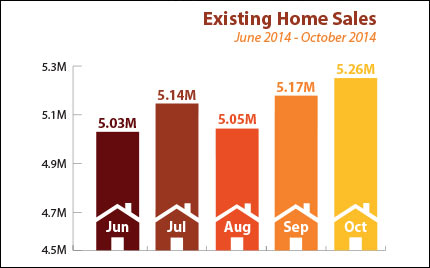

The housing sector continues to be a bright spot, as Existing Home Sales in October reached their best level since September 2013, coming in at 5.26 million units. Low home loan rates and an improving job market are two key factors that drove buyer decisions.

The housing sector continues to be a bright spot, as Existing Home Sales in October reached their best level since September 2013, coming in at 5.26 million units. Low home loan rates and an improving job market are two key factors that drove buyer decisions.

There was also a double dose of good news on the builder side. Building Permits, a sign of future construction, reached their highest level since November of last year. And the National Association of Home Builders (NAHB) reported that its November Housing Market Index rebounded to 58, up four points from October. The NAHB Housing Market Index gauges builder perceptions of current single-family home sales, and readings over 50 are seen as positive.

The one downside from the housing sector came from October Housing Starts, which declined from September. It’s important to note that within the report, starts for single family homes increased 4.2 percent, while multi-family dwellings fell by 15.4 percent. More housing reports are ahead in the coming week. Will they also signal a continued recovery in the housing sector?

And there’s another thing to watch in the next week, as Personal Consumption Expenditures (the Fed’s favorite measure of inflation) will be released. While inflation on the consumer side via the Consumer Price Index remained tame in October, wholesale inflation came in hotter than expected. While one month doesn’t constitute a trend—and expectations are for inflation to remain cool—remember that inflation is bad for Bonds, as it impacts the value of fixed investments like Bonds. This means inflation can also cause home loan rates to worsen, as home loan rates are tied to Mortgage Bonds.

The bottom line is that at this time, home loan rates remain near some of their best levels of the year, and now is a great time to consider a home purchase or refinance