Guest Post – Tradition Mortgage’s Weekly Update May 19, 2015

“Free. Free. Set them free.” Sting. Mortgage Bonds fell beneath a key technical level, finally managing to break free late in the week. But can they maintain an improving trend? Read on for details and all the latest headlines.

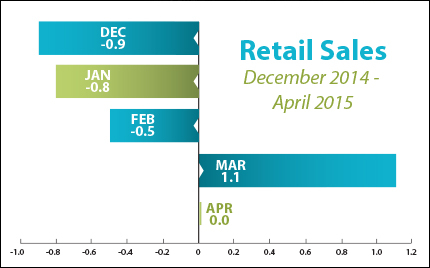

Retail Sales came in flat for April, as many consumers tucked away savings from lower gasoline prices, rather than spend money on big ticket items. Stagnant wages coupled with mixed feelings about the economy were a few reasons for the ease in spending. Other than the positive reading in March, Retail Sales have been negative in recent months. It will be important to see if spending picks up this summer.

Retail Sales came in flat for April, as many consumers tucked away savings from lower gasoline prices, rather than spend money on big ticket items. Stagnant wages coupled with mixed feelings about the economy were a few reasons for the ease in spending. Other than the positive reading in March, Retail Sales have been negative in recent months. It will be important to see if spending picks up this summer.

There was some good news from the labor sector, as Weekly Initial Jobless Claims continue to hover near a 15-year low. And the Producer Price Index, which measures inflation at the wholesale level, came in lower than expected, down seven of the last nine months thanks to lower costs for food and gasoline.

Inflation remains tame, which is good news for Mortgage Bonds, as inflation reduces the value of fixed investments like Bonds. Tame inflation is also good news for home loan rates, as they are tied to Mortgage Bonds.

The markets have been volatile, but after a steep plunge, Mortgage Bonds rallied in the latest week. Home loan rates remain attractive, making now a great time to consider a home purchase or refinance.

Jim Krantz

Vice President

NMLS # 761955

Jim.Krantz@TraditionLLC.com

Direct 952.252.4488 / Cell 612.716.9999 / Fax 952.252.4489

Tradition Mortgage LLC

NMLS # 286998

4350 Baker Rd Suite 190 / Minnetonka, MN 55343 / www.TraditionWest.com