Solid Retail Sales

After a slow start to the year, Friday’s report on retail sales went a long way to increase optimism about stronger economic growth during the second quarter. April core retail sales jumped 0.8% from March, which was far more than expected. It was the largest monthly gain in nearly a year. The results for March also were revised higher. As a result, mortgage rates ended the week a little higher, but they remain near the best levels of the year.

In labor related news, nice gains were seen in the JOLTS report, which measures job openings and labor turnover rates. The JOLTS report helps to provide a broader picture of the performance of the labor market. Job openings in March increased to levels which were very close to record highs. Continued improvement in employment creates wage pressure on businesses, which is a good thing for employees, but is also an inflationary element and pushes rates upward.

Week Ahead

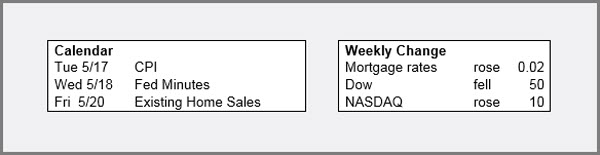

Factors: The two biggies this week are: The Consumer Price Index (CPI), a widely followed monthly inflation report, will come out on Tuesday. CPI looks at the price change for goods and services which are sold to consumers. The Fed Minutes from the April 27 meeting will come out on Wednesday. These detailed minutes provide additional insight into the debate between Fed officials and have the potential to significantly move markets.

Volatility: Moderate

Trend: Neutral

Have a great day!

Jim Krantz

Vice President

NMLS # 761955

Jim.Krantz@TraditionLLC.com

Direct 952.252.4488 / Cell 612.716.9999 / Fax 952.252.4489

Tradition Mortgage LLC

NMLS # 286998

4350 Baker Rd Suite 190 / Minnetonka, MN 55343 / www.TraditionWest.com