Economic reports don’t begin until Thursday, but the end of the week features several key data points to note.

- Weekly Initial Jobless Claims will be released on Thursday, as usual.

- Also on Thursday, Retail Sales for February will be released.

- Friday brings the Producer Price Index, which measures wholesale inflation, along with the Consumer Sentiment Index.

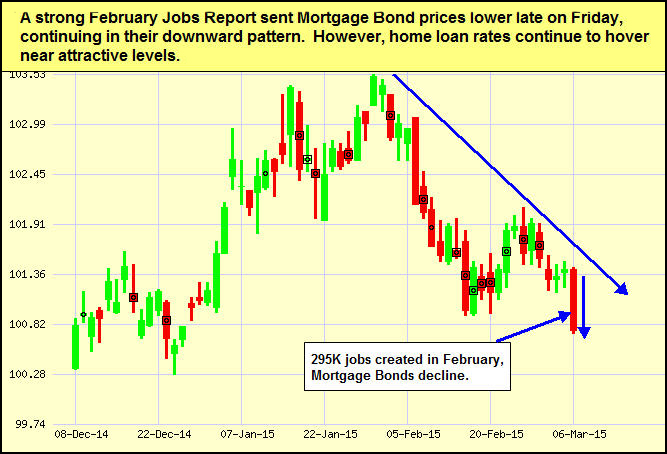

Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result. The chart below shows Mortgage Backed Securities (MBS), which are the type of Bond on which home loan rates are based.

When you see these Bond prices moving higher, it means home loan rates are improving—and when they are moving lower, home loan rates are getting worse.

To go one step further—a red “candle” means that MBS worsened during the day, while a green “candle” means MBS improved during the day. Depending on how dramatic the changes were on any given day, this can cause rate changes throughout the day, as well as on the rate sheets we start with each morning.

As you can see in the chart below, Mortgage Bonds have declined recently. Home loan rates remain attractive and I will continue to monitor them closely.

Chart: Fannie Mae 3.0% Mortgage Bond (Friday Mar 06, 2015)

Jim Krantz

Vice President

NMLS # 761955

Jim.Krantz@TraditionLLC.com

Direct 952.252.4488 / Cell 612.716.9999 / Fax 952.252.4489

Tradition Mortgage LLC

NMLS # 286998

4350 Baker Rd Suite 190 / Minnetonka, MN 55343 / www.TraditionWest.com