Wage Increases Stop Rate Rally

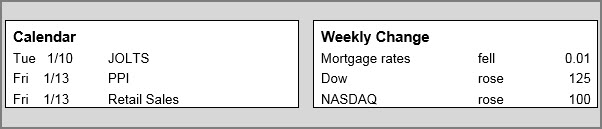

From the presidential election until the last few days of the year, the trend in bond yields was upward, and this kept many potential bond buyers on the sidelines. Buyers finally stepped in at the end of the year and then paused early this week. It appears that they were waiting until a major risk, the Minutes from the December 14 Fed meeting, was out of the way. When there were no surprises in the Minutes, investors felt comfortable purchasing bonds again. The rush to buy intensified on Thursday, pushing mortgage rates to the best levels in a month, but Friday’s economic data halted the rally.

The most notable aspect of Friday’s closely watched monthly Employment report was an upside surprise in wage growth in December. Average hourly earnings were 2.9% higher than a year ago, up from 2.5% last month, and the highest level since 2009. While wage increases are great for workers, those same increases can create inflation and higher rates.

Another important economic report released earlier in the week also hinted at higher future inflation. Manufacturers reported that they expect a large increase in the prices to be paid for producing goods. Since it reduces the value of future cash flows, inflation is negative for mortgage rates. Already wary about inflation due to the manufacturing report, investors pushed mortgage rates higher after the wage data.

- Week Ahead

Volatility: Moderate

Trend: Neutral

This information is intended for professional reference only, and not intended for consumer use. Additional qualifications and disclosures apply.

Have a great day!

Jim Krantz

Vice President

NMLS # 761955

Jim.Krantz@TraditionLLC.com

Direct 952.252.4488 / Cell 612.716.9999 / Fax 952.252.4489