Guest Post – Tradition Mortgage’s Weekly Update January 19, 2015

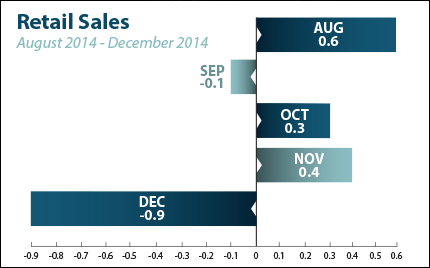

Shop or drop. Fewer people than expected opened their wallets in December, as the latest Retail Sales numbers declined. But with home loan rates hovering near historic lows, not all of last week’s headlines were disappointing.

Retail Sales plunged by 0.9 percent in December, the biggest decline in nearly a year as lower gas prices didn’t have the desired impact on consumer spending during the busy shopping season. November’s numbers were also revised lower. This news was a bit of a surprise, and not the best sign for our overall economic recovery. But one number doesn’t make a trend, so this will be an important report to watch in the coming months.

Retail Sales plunged by 0.9 percent in December, the biggest decline in nearly a year as lower gas prices didn’t have the desired impact on consumer spending during the busy shopping season. November’s numbers were also revised lower. This news was a bit of a surprise, and not the best sign for our overall economic recovery. But one number doesn’t make a trend, so this will be an important report to watch in the coming months.

On the inflation front, inflation at the wholesale level remained tamed in December while the Consumer Price Index showed its smallest gain in five years, mainly due to plunging oil prices. We are beginning to see disinflationary pressures, which is a slower rate of inflation over a shorter time period. While low inflation is Bond-friendly news (and also good for home loan rates, since they are tied to Mortgage Bonds), outright deflation is a sustained fall in prices. That is something we do not want to see because deflation also brings increased unemployment. Inflation is another key item to monitor as we move ahead into 2015.

Also of note, the World Bank cut its forecast for global growth, warning that the world economy remains overly reliant on the “single engine” of the U.S. recovery. If negative news from overseas continues, we could see safe haven trading into our Bond market, helping Mortgage Bonds and home loan rates in the process.

The bottom line is that home loan rates remain near historic lows, and now is a great time to consider a home purchase or refinance.