Guest Post – Tradition Mortgage’s Weekly Update February 9, 2015

“Yet, through all the gloom, I can see the rays of ravishing light and glory.” John Adams. The gloom of recent years seems to be gone from the labor sector, as it is a bright spot in our economy at the start of this year.

The January Jobs Report showed that 257,000 jobs were created, above the 235,000 expected, as the sector continues to produce robust gains. In addition, job creations for November and December were revised sharply higher by 147,000. The last three months have averaged 336,000 new hires, the best three-month period in the last 17 years. January marked the 11th straight month of job gains above 200,000, the longest streak since 1994.

The January Jobs Report showed that 257,000 jobs were created, above the 235,000 expected, as the sector continues to produce robust gains. In addition, job creations for November and December were revised sharply higher by 147,000. The last three months have averaged 336,000 new hires, the best three-month period in the last 17 years. January marked the 11th straight month of job gains above 200,000, the longest streak since 1994.

Also of note, the Unemployment Rate ticked up slightly to 5.7 percent from 5.6 percent, while hourly earnings came in above expectations. It will be important to monitor future hourly earnings readings, as growth in this area could cause an increase in inflation. Since inflation is the kryptonite for fixed investments like Mortgage Bonds, it can also be bad news for home loan rates (which are tied to Mortgage Bonds).

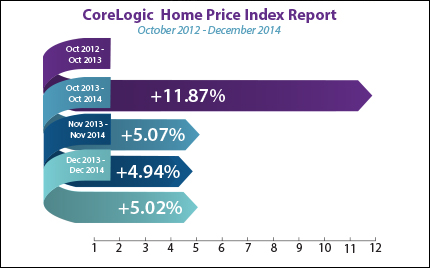

Over in housing, research firm CoreLogic reported that home prices, including distressed sales, rose by 5 percent from December 2013 to December 2014. Home price gains continue to stabilize at more normal levels from the double digit gains seen in the past few years. While the 5 percent gain is the 34th month of consecutive year-over-year increases in home prices nationally, prices are still 13.4 percent below their April 2006 peak.

The bottom line is that now is a great time to consider a home purchase or refinance.