![]() It’s been said that every cloud has a silver lining. And while some key reports from last week could mean stormy skies ahead for our economy, the “silver lining” from the worse than expected news was that it helped home loan rates improve. Read on for key details.

It’s been said that every cloud has a silver lining. And while some key reports from last week could mean stormy skies ahead for our economy, the “silver lining” from the worse than expected news was that it helped home loan rates improve. Read on for key details.

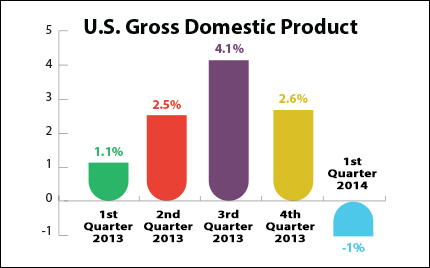

Perhaps the biggest “cloud” for our economy last week came with the second reading on Gross Domestic Product (GDP) for the first quarter, which came in at -1.0 percent after the initial read of 0.1 percent. This is the first negative reading for GDP since the first quarter of 2011. GDP is the broadest measure of economic activity, and it will be important to see if the number improves as we head further into 2014.

In housing news, research firm CoreLogic reported that there were 46,000 completed foreclosures in April, down 18 percent from April 2013. Before the housing market decline in 2007, completed foreclosures averaged 21,000 per month between 2000 and 2006. In addition, the Case Shiller 20-city Home Price Index grew at an annual rate of 12.4 percent in March. Overall, the report showed that housing prices are rising at more normal levels after the big gains seen in 2013.

Also of note, signs of inflation are starting to creep into our economy. Core Personal Consumption Expenditures (the Fed’s favorite read on inflation) rose to 1.4 percent in April, after a 1.1 percent rise in March and a 0.9 percent gain in February. April’s reading is the highest 12-month rate since March 2013.

What does this mean for home loan rates?Remember that home loan rates are tied to Mortgage Bonds, so as Bonds improve, rates improve. Mortgage Bonds have improved lately for many reasons, including our tepid economy, the weakened Euro and the Fed’s big Bond-buying program. In addition, the uncertainty with Russia and the Ukraine has caused investors to move their money out of Stocks and into less risky assets like Bonds.

But rising inflation is something to keep an eye on. Inflation is the arch enemy of Bonds, as inflation reduces the value of fixed investments like Bonds. If inflation continues to heat up, Bonds could worsen, which would impact the improvement we’ve seen in home loan rates.

The bottom line is that now remains a great time to consider a home purchase or refinance. Home loan rates remain attractive compared to historical levels, and they’re at some of the best levels seen this year.

Taylor, Scott L. age 42 of Eagan, Officer with the Mpls Police Dept, passed away unexpectedly May 19, 2014. Preceded in death by his father, Glenn Taylor and grandfather, Loren Taylor. Survived by his wife, Stephanie; sons, Justin and Brandon; mother, Joyce Taylor; brother, Todd (Shannon) Taylor; grandmothers, Dorothy Jansen and Mae Taylor; nieces, nephews, cousins, aunts, uncles, and parents-in-law, Rick and Karen Haase. Graduated from Bloomington Kennedy High School 1990 and Winona State University 1995. Joined the Mpls Police Dept. March of 1997. Visitation Wednesday 4-8 PM, funeral service Thursday 11 AM with visitation 1 hour before all at the Washburn-McReavy Funeral Chapel, West 50th St. & Hwy 100, Edina. Interment Dawn Valley Cemetery. In lieu of flowers, memorials are preferred to the family for his sons’ education.

Taylor, Scott L. age 42 of Eagan, Officer with the Mpls Police Dept, passed away unexpectedly May 19, 2014. Preceded in death by his father, Glenn Taylor and grandfather, Loren Taylor. Survived by his wife, Stephanie; sons, Justin and Brandon; mother, Joyce Taylor; brother, Todd (Shannon) Taylor; grandmothers, Dorothy Jansen and Mae Taylor; nieces, nephews, cousins, aunts, uncles, and parents-in-law, Rick and Karen Haase. Graduated from Bloomington Kennedy High School 1990 and Winona State University 1995. Joined the Mpls Police Dept. March of 1997. Visitation Wednesday 4-8 PM, funeral service Thursday 11 AM with visitation 1 hour before all at the Washburn-McReavy Funeral Chapel, West 50th St. & Hwy 100, Edina. Interment Dawn Valley Cemetery. In lieu of flowers, memorials are preferred to the family for his sons’ education.  Hitchens, Ralph Norman age 88, of NE Mpls, passed away peacefully May 8, 2014 surrounded by family. Preceded in death by his wife, Jean. He will be missed by his children, Nowell (Tom) Hodnett of CA, Shelly (Jerry) Madden, John (Judy) Hitchens of GA, Denise (Jim) Caputa, Cheryl (Brad) Earley; 9 grandchildren, 12 great-grandchildren; sister, Lil McKinnon of IL; brother, Len Hitchens of British Columbia; other relatives & friends. Ralph was born in Minneapolis and raised in Winnipeg, Manitoba, that is where his love for hockey began. Serving his country in the US Navy during WWII, he was stationed in Farragut, ID and San Francisco, CA. He returned to Mpls to attend the University of MN. In Dec. 1947 he married Jean Kevelin and together raised five children. In 1959 he joined the Minneapolis Police Dept. He spent several years managing Duff’s. He then returned to the Mpls Police Dept. He served as Chief of Police in the Litchfield Police Dept and retired as Chief of Police for the City of Brain- erd. A Celebration of Ralph’s life will be held Tuesday, May 13, 5-9 PM at Elsie’s, 729 Marshall St. NE, Mpls. Private family service and interment at Fort Snelling. Memorials may be directed to Catholic Eldercare.

Hitchens, Ralph Norman age 88, of NE Mpls, passed away peacefully May 8, 2014 surrounded by family. Preceded in death by his wife, Jean. He will be missed by his children, Nowell (Tom) Hodnett of CA, Shelly (Jerry) Madden, John (Judy) Hitchens of GA, Denise (Jim) Caputa, Cheryl (Brad) Earley; 9 grandchildren, 12 great-grandchildren; sister, Lil McKinnon of IL; brother, Len Hitchens of British Columbia; other relatives & friends. Ralph was born in Minneapolis and raised in Winnipeg, Manitoba, that is where his love for hockey began. Serving his country in the US Navy during WWII, he was stationed in Farragut, ID and San Francisco, CA. He returned to Mpls to attend the University of MN. In Dec. 1947 he married Jean Kevelin and together raised five children. In 1959 he joined the Minneapolis Police Dept. He spent several years managing Duff’s. He then returned to the Mpls Police Dept. He served as Chief of Police in the Litchfield Police Dept and retired as Chief of Police for the City of Brain- erd. A Celebration of Ralph’s life will be held Tuesday, May 13, 5-9 PM at Elsie’s, 729 Marshall St. NE, Mpls. Private family service and interment at Fort Snelling. Memorials may be directed to Catholic Eldercare.  72 year old resident of Little Falls, MN passed away Sunday, May 4, 2014 at the St. Cloud Hospital surrounded by his loving family. A Mass of Christian Burial will be held at 11:00 A.M. on Thursday, May 8, 2014 at Our Lady of Lourdes Catholic Church in Little Falls, MN with Father Joe Herzing officiating. Visitation will be from 5-8 PM on Wednesday and from 9-10:30 AM on Thursday at the Shelley Funeral Chapel in Little Falls. Howard is survived by his wife, Rita Richner; daughters, Laura Hilmerson, Denise (Randy) Heltemes and Anne (Wayne) Seymour. Shelley Funeral Chapel Little Falls, MN (320) 632-5242 www.shelleyfuneralchapels.com

72 year old resident of Little Falls, MN passed away Sunday, May 4, 2014 at the St. Cloud Hospital surrounded by his loving family. A Mass of Christian Burial will be held at 11:00 A.M. on Thursday, May 8, 2014 at Our Lady of Lourdes Catholic Church in Little Falls, MN with Father Joe Herzing officiating. Visitation will be from 5-8 PM on Wednesday and from 9-10:30 AM on Thursday at the Shelley Funeral Chapel in Little Falls. Howard is survived by his wife, Rita Richner; daughters, Laura Hilmerson, Denise (Randy) Heltemes and Anne (Wayne) Seymour. Shelley Funeral Chapel Little Falls, MN (320) 632-5242 www.shelleyfuneralchapels.com Miltz, Dennis Edgar 78, of Rogers, MN, passed away at the Wellstead of Rogers on Wednesday, April 23rd, 2014. Mass of Christian Burial MONDAY 4/28 11:00 AM Mary Queen of Peace Catholic Church in Rogers, MN. Visitation one hour prior to Mass AT THE CHURCH. Dennis was born on March 15, 1936 in Minneapolis, MN to Wilfred and Dorothy (Hagel) Miltz. Dennis served the United States in the Marine Corp for 3 years. Dennis married Lois Raguse on May 19th, 1962 in Minneapolis. They were married for 34 years. He also served as a Minneapolis Police Officer from 1963-1988, when he retired as a Sergeant. Additionally, he served the city of Rogers, MN as Chief of Police from 1971-2001. He then served Rogers as Mayor for one term. Dennis was proud to serve his country and communities as a Marine, Law Enforcement Officer and Mayor. He enjoyed fishing and boating, and time at the cabin with his family and friends. He demonstrated his pride in his German Heritage in his love for German music, teaching himself to speak German and travels to Austria and Germany. Dennis is survived by his and Lois’s 4 children, Maren (Paul) Scherber, Greg (Shari) Miltz, Gretchen (John) Patnode, and Jason (Michelle) Miltz. In addition he is survived by 11 grandchildren and 4 great-grandchildren and his sister Michelle (Roy) Haflund. He was preceded in death by his parents, his wife Lois, and his sister, Roseanne. In lieu of flowers, it is preferred that memorial donations be made to either LEMA (Law Enforcement Memorial Association) or the St. Michael Foundation, in his name. Serving the family… The Peterson Chapel St. Michael-Albertville Funeral Home 763-497-5362 www.thepetersonchapel.com

Miltz, Dennis Edgar 78, of Rogers, MN, passed away at the Wellstead of Rogers on Wednesday, April 23rd, 2014. Mass of Christian Burial MONDAY 4/28 11:00 AM Mary Queen of Peace Catholic Church in Rogers, MN. Visitation one hour prior to Mass AT THE CHURCH. Dennis was born on March 15, 1936 in Minneapolis, MN to Wilfred and Dorothy (Hagel) Miltz. Dennis served the United States in the Marine Corp for 3 years. Dennis married Lois Raguse on May 19th, 1962 in Minneapolis. They were married for 34 years. He also served as a Minneapolis Police Officer from 1963-1988, when he retired as a Sergeant. Additionally, he served the city of Rogers, MN as Chief of Police from 1971-2001. He then served Rogers as Mayor for one term. Dennis was proud to serve his country and communities as a Marine, Law Enforcement Officer and Mayor. He enjoyed fishing and boating, and time at the cabin with his family and friends. He demonstrated his pride in his German Heritage in his love for German music, teaching himself to speak German and travels to Austria and Germany. Dennis is survived by his and Lois’s 4 children, Maren (Paul) Scherber, Greg (Shari) Miltz, Gretchen (John) Patnode, and Jason (Michelle) Miltz. In addition he is survived by 11 grandchildren and 4 great-grandchildren and his sister Michelle (Roy) Haflund. He was preceded in death by his parents, his wife Lois, and his sister, Roseanne. In lieu of flowers, it is preferred that memorial donations be made to either LEMA (Law Enforcement Memorial Association) or the St. Michael Foundation, in his name. Serving the family… The Peterson Chapel St. Michael-Albertville Funeral Home 763-497-5362 www.thepetersonchapel.com Urbik, Conrad A. April 30, 1940 – April 17, 2014 age 73, of Royalton, MN, passed away Thursday at the St. Cloud Hospital. Conrad was a police officer at the Minneapolis Police Department for 26 years, retiring in 1996 and was also a Navy veteran serving from 1958-1964. He is survived by wife, Linda; children, Ellen (Gary) Galbavy of Stillwater, David Urbik of Minneapolis, Mary (Pat) Wenker of Greenwald; mother, Mary Madsen of Minneapolis; sister, Cleo (Tom) Ziesmer of Minneapolis, stepsister Linda (Tim Klinkhammer) Madsen of Ham Lake and 4 grandchildren. Preceded in death by father; sister, Bonnie Launderville and stepdad, Harald Madsen. Memorial services will be 11:00 a.m. Friday, April 25 at the Newman Center, Rev. Jeremy Ploof will officiate and burial will be at Minnesota State Veterans Cemetery in Little Falls. Visitation will be 4:00 – 8:00 p.m. Thursday, April 24 at Williams Dingmann Family Funeral Home in Sauk Rapids and one hour prior to service Friday at the Newman Center. Rice American Legion Post 473 prayer service will be 6:00 p.m. Friday at the Funeral Home. In lieu of flowers, memorials preferred to Wendy’s Wonderful Kids or the Tri County Humane Society. Condolences: williamsdingmann.com

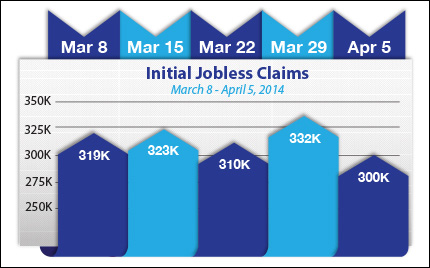

Urbik, Conrad A. April 30, 1940 – April 17, 2014 age 73, of Royalton, MN, passed away Thursday at the St. Cloud Hospital. Conrad was a police officer at the Minneapolis Police Department for 26 years, retiring in 1996 and was also a Navy veteran serving from 1958-1964. He is survived by wife, Linda; children, Ellen (Gary) Galbavy of Stillwater, David Urbik of Minneapolis, Mary (Pat) Wenker of Greenwald; mother, Mary Madsen of Minneapolis; sister, Cleo (Tom) Ziesmer of Minneapolis, stepsister Linda (Tim Klinkhammer) Madsen of Ham Lake and 4 grandchildren. Preceded in death by father; sister, Bonnie Launderville and stepdad, Harald Madsen. Memorial services will be 11:00 a.m. Friday, April 25 at the Newman Center, Rev. Jeremy Ploof will officiate and burial will be at Minnesota State Veterans Cemetery in Little Falls. Visitation will be 4:00 – 8:00 p.m. Thursday, April 24 at Williams Dingmann Family Funeral Home in Sauk Rapids and one hour prior to service Friday at the Newman Center. Rice American Legion Post 473 prayer service will be 6:00 p.m. Friday at the Funeral Home. In lieu of flowers, memorials preferred to Wendy’s Wonderful Kids or the Tri County Humane Society. Condolences: williamsdingmann.com There was good news in the labor markets, as weekly Initial Jobless Claims fell by 32,000 in the latest week to 300,000. This was near a seven-year low and a signal that the labor markets may be coming out of hibernation as spring starts to bloom. In addition the 4-week moving average of claims, which irons out seasonal abnormalities, also fell. Meanwhile, the Consumer Sentiment Index for April came in above expectations, showing that consumers are feeling positive about the economy as we head into warmer months.

There was good news in the labor markets, as weekly Initial Jobless Claims fell by 32,000 in the latest week to 300,000. This was near a seven-year low and a signal that the labor markets may be coming out of hibernation as spring starts to bloom. In addition the 4-week moving average of claims, which irons out seasonal abnormalities, also fell. Meanwhile, the Consumer Sentiment Index for April came in above expectations, showing that consumers are feeling positive about the economy as we head into warmer months.