Media Advisory

January 4, 2014

Minneapolis and Saint Paul Police Union Presidents co-author letter to the community addressing the recent attacks on officers and the law enforcement profession.

In light of attacks on peace officers across the nation, including the recent tragedy in New York involving the execution of two police officers, and in response to the hostile climate in which the nation’s law enforcement officers find themselves living and working, we as leaders of the Minneapolis and Saint Paul police unions feel it is important to speak out publicly on behalf of our members, and law enforcement officers everywhere.

Our organizations have always advocated for, and unequivocally supported, the high educational and professional standards applied to our members. As one of the few states in the nation that requires officers to obtain–at the very least–a college degree in law enforcement, and mandates professional licensing, Minnesota stands tall in this area. The men and women wearing blue each and every day on the streets of Saint Paul and Minneapolis endeavor to serve the public in a professional and ethical manner, and to treat citizens with respect and dignity. We believe that they accomplish this goal the vast majority of the time.

Certainly, there have been instances where our officers have fallen short of the line, and we believe that we have been quick to acknowledge these instances. No other profession polices itself so strictly, or is more scrutinized internally and externally with more levels of review, than law enforcement. We do not disagree that disciplinary action and even criminal prosecution of officers in certain circumstances is appropriate.

However, it seems we have reached the point where it has become permissible for those whose

words may carry significant weight with the public to make irresponsible public comments

regarding the actions of certain officers on both sides of the river, and elsewhere. It seems that too often lately we have found ourselves living in a world where “feelings” count for more than facts, and officers are judged prematurely within the context of media “feeding frenzies” before the truth of any given situation can be discovered through a thorough and impartial investigation.

Those who make such comments need to understand the danger of contributing to these often false or inaccurate publicly-broadcast narratives. When this occurs, the impact on individual law enforcement officers, and law enforcement officers as a whole, can be devastating not only for the officers but for the rule of law itself. Ultimately, public safety is compromised.

As we move foreword as communities through this difficult time in American history, we urge those with a voice to measure their words and reserve judgement in these situations until the facts can be brought to light. Instantly condemning officers and their actions, and fueling the fire by making reactionary comments benefits no one, and in fact, as we saw on the streets of New York, can lead to tragedy.

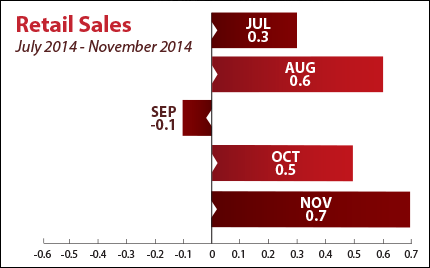

Consumer sentiment surged to 93.8 in December, reaching the highest level since January 2007 and the recent recession. In line with that sentiment, consumers also opened their wallets in November, spending money on goods ranging from cars to clothing as the holiday shopping season got underway. Retail Sales rose by 0.7 percent in November, which was the fastest rate in eight months.

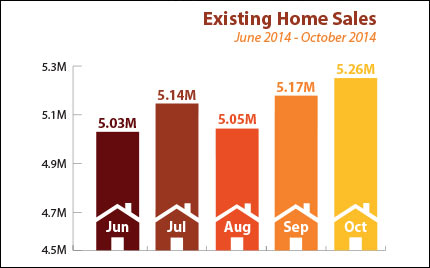

Consumer sentiment surged to 93.8 in December, reaching the highest level since January 2007 and the recent recession. In line with that sentiment, consumers also opened their wallets in November, spending money on goods ranging from cars to clothing as the holiday shopping season got underway. Retail Sales rose by 0.7 percent in November, which was the fastest rate in eight months. The housing sector continues to be a bright spot, as Existing Home Sales in October reached their best level since September 2013, coming in at 5.26 million units. Low home loan rates and an improving job market are two key factors that drove buyer decisions.

The housing sector continues to be a bright spot, as Existing Home Sales in October reached their best level since September 2013, coming in at 5.26 million units. Low home loan rates and an improving job market are two key factors that drove buyer decisions. In the labor sector, Weekly Initial Jobless Claims came in at 290,000. Claims have remained below 300,000 for nine straight weeks—a feat that has not occurred since 2000. In addition, claims are 20 percent lower than they were this time one year ago. However, all is not golden as 18.2 million Americans still say they can’t find a full-time job. This is a big number, considering that we’re five years into an economic recovery. While the labor sector is improving, there is still more work needed ahead.

In the labor sector, Weekly Initial Jobless Claims came in at 290,000. Claims have remained below 300,000 for nine straight weeks—a feat that has not occurred since 2000. In addition, claims are 20 percent lower than they were this time one year ago. However, all is not golden as 18.2 million Americans still say they can’t find a full-time job. This is a big number, considering that we’re five years into an economic recovery. While the labor sector is improving, there is still more work needed ahead. In recent weeks, Stocks have seen a sell-off while Mortgage Bonds have pushed considerably higher. Why has this happened? Concerns about slowing global economic growth have pushed investors into the safe haven of the Bond market, and investors have also secured profits with Stock prices near all-time highs.

In recent weeks, Stocks have seen a sell-off while Mortgage Bonds have pushed considerably higher. Why has this happened? Concerns about slowing global economic growth have pushed investors into the safe haven of the Bond market, and investors have also secured profits with Stock prices near all-time highs.