Scott J. Dahlquist retired after 26 years of “outstanding service to the Minneapolis Police Department” (at least that’s what his retirement plaque says) on May 17, 2014, after serving primarily as a patrol officer in the 4th Precinct, but also successfully completing short term assignments in the Robbery, Sex Crimes, Juvenile, Financial Crimes, and Precinct Investigative Units; as well as serving in the SAFE Unit and for two years as the 4th Precinct’s CODEFOR coordinator.

I find that retirement suits me well. I am active with volunteer activities with my church and Boy Scouts, and work occasionally as a program assistant with the law enforcement program at Hennepin Technical College. As a program assistant I assist the instructors by role playing in a scenario they design, and then offer feedback to the students about their performance.

During my career I came really close to shooting a person only once; two drunks started fighting each other in front of 1010 Currie when one of them pulled out a knife and was about to stab the other, I ordered him to drop his knife at gunpoint, and he did. I then arrested him for a felony assault, but he was only charged with a misdemeanor when the “victim” couldn’t be located. Also, I was attacked by large dogs three separate times, firing a total of five rounds from my handgun, killing two and wounding one.

One of my most favorite memories: I was part of an arrest team for a protest at the federal court house against the second gulf war. About two dozen students sat down and refused to leave, and were then arrested and put on an MTC bus in buildings garage to be transported to the jail. I was on the bus with them, and after the initial tension subsided they began to sing various protest songs. One of them invited me to sing along, and I replied “I‘ve taken the Queen’s shilling lad, wouldn’t be appropriate for me to do so.” If you want me to explain the historical context of this remark I would be glad to do so.

Advice for someone just starting out: There are four distinct areas that threats to your career and life can come from, and that all have to be managed differently.

The first is of course the external threats; people who will try and hurt or kill with you guns, knives, hands, feet, cars, blunt instruments, and various other devices. There is a great deal of information out there about how to recognize and deal with these, read up on them.

The second area is your own department. There may come a time in your career where your interest and theirs are in conflict. Avoid this as much as possible by doing your best to ensure that your actions are in compliance with the law, department policy, the latest court rulings about what constitutes reasonable behavior, and the work direction of your supervisors (caution: the longer you are on the more irksome that last will become as people with far less experience and sometimes less ability are promoted over you). If it can’t be avoided, then some things can only be endured with as much dignity and grace as you can muster, and realizing that although you may not be able to make a situation better, it always possible to make it worse.

The third is your own co-workers. You will find some really great brothers and sisters in arms, you will take a bullet for them, and they will take one for you; you will also encounter a few great schmucks, who will only be revealed after fact. This is perhaps the hardest threat to deal with of all.

The last is your own internal landscape. The path of least resistance is to give into bitterness, despair, and cynicism; and to seek solace in alcohol, drugs, and/or personally reckless behavior. Try and find something away from the job that gives you hope and a positive outlook, for this job and any police department will slowly grind the positive out of you.

Lastly, remember that as important as this job is and as important as you think you are, the only thing any us are destined to be is a picture on a wall and a bit player in someone else’s war story.

Look me up via Linked-in if you want to get in touch with me.

Kurtz, George age 66, of Pine City. Retired Minneapolis Police Officer, passed away December 10, 2014. Survived by wife Karen, son Tony (Shannon) Kurtz, daughter Sara (Luis) De La Riva, 4 grandchildren, brothers Jesse (Paula) Kurtz, Bill (Kari) Kurtz, Marty Kurtz, father-in-law and mother-in-law Doug & JoAnn Awalt, sister-in-law Kim (Steve) Middleton, brothers-in-law Kevin Awalt, Kenneth (Linda) Awalt; best friends Bob Hunt and Bill Suko, many nieces, nephews, and good friends. Preceded in death by 3 sons, his mother & one sister. Swanson Funeral Chapel 320-629-3120 funeralandcremationservice.com

Kurtz, George age 66, of Pine City. Retired Minneapolis Police Officer, passed away December 10, 2014. Survived by wife Karen, son Tony (Shannon) Kurtz, daughter Sara (Luis) De La Riva, 4 grandchildren, brothers Jesse (Paula) Kurtz, Bill (Kari) Kurtz, Marty Kurtz, father-in-law and mother-in-law Doug & JoAnn Awalt, sister-in-law Kim (Steve) Middleton, brothers-in-law Kevin Awalt, Kenneth (Linda) Awalt; best friends Bob Hunt and Bill Suko, many nieces, nephews, and good friends. Preceded in death by 3 sons, his mother & one sister. Swanson Funeral Chapel 320-629-3120 funeralandcremationservice.com Shoemaker, Herbert G. age 85 of Brooklyn Park, MN. Passed away September 18, 2014 at North Memorial Medical Center in Robbinsdale. Preceded in death by parents, two brothers, infant son & grandson. Herb was born in Duluth on September 30, 1928 and grew up in Minneapolis. He graduated from Patrick Henry High, married his 1st wife in 1951 and had 6 children. Herb served in the U.S. Army during the Korean conflict and 26 years on the Minneapolis Police Department, retiring in 1981 as Detective Lieutenant. He was a long time member of American Legion, VFW and Minneapolis Lodge No. 19 A.F. & A.M. Herb married the love of his life, Marie on 11-23-68 in Watertown, S.D. They purchased a travel trailer in 1985 and spent many summers in the city owned campground in Sauk Centre. Survived by his wife of 45 years, Marie; sister, Bev Green; daughters, Carole (Scott) Pearson, Terry (Rick) Moeller, Barbara Elfenbein, and Dene (Tim) Holmquist; son Steven (Susan) Shoemaker; grandchildren; great-grandchildren; and many other family & friends. A memorial service is planned Tuesday, September 30th- 7-9 pm at the Cremation Society of MN, 7835 Brooklyn Blvd., Brooklyn Park, MN. 763-560-3100.

Shoemaker, Herbert G. age 85 of Brooklyn Park, MN. Passed away September 18, 2014 at North Memorial Medical Center in Robbinsdale. Preceded in death by parents, two brothers, infant son & grandson. Herb was born in Duluth on September 30, 1928 and grew up in Minneapolis. He graduated from Patrick Henry High, married his 1st wife in 1951 and had 6 children. Herb served in the U.S. Army during the Korean conflict and 26 years on the Minneapolis Police Department, retiring in 1981 as Detective Lieutenant. He was a long time member of American Legion, VFW and Minneapolis Lodge No. 19 A.F. & A.M. Herb married the love of his life, Marie on 11-23-68 in Watertown, S.D. They purchased a travel trailer in 1985 and spent many summers in the city owned campground in Sauk Centre. Survived by his wife of 45 years, Marie; sister, Bev Green; daughters, Carole (Scott) Pearson, Terry (Rick) Moeller, Barbara Elfenbein, and Dene (Tim) Holmquist; son Steven (Susan) Shoemaker; grandchildren; great-grandchildren; and many other family & friends. A memorial service is planned Tuesday, September 30th- 7-9 pm at the Cremation Society of MN, 7835 Brooklyn Blvd., Brooklyn Park, MN. 763-560-3100. Peterson, Carl A. age 96, lifetime resident of NE Mpls, passed away peacefully surrounded by family on Sunday, July 27, 2014. Preceded in death by parents, Carl & Anna and brother, Harry. Survived by Alice, his loving wife of 67 years; daugh ter, Ruth (Rev. Gary) Moen; sons, Carl (Carol), Mark, David (Margy), and James; grandchildren, Heather (Byron) Gerard, Elizabeth (Matt) Mekelburg, Jonathan (Kendall) Moen, Ben (Holly), Joey (Candice), Jeff (Betsy), Emma, Abram, and Izaak; great-grandchildren, Caleb, Kaitlyn, Sarah, Emily, Jacob, Micah, Grace, Reid, Annabel and Evelyn; sister, Mae Bergstrom. Also survived by many nieces & nephews, other family and friends. Served with commendations in the Minneapolis Police Dept. He was a Sergeant with the Army Air Corps during WWII and a builder of many fine homes in the metro area. In lieu of flowers, memorials preferred to Elim Church, where he was a lifetime, faithful member. Interment with military honors, Sunset Cemetery. Funeral service Saturday, Aug. 2, 10:30 AM, with visitation one hour before at Elim Church, 685 13th Ave NE. Visitation also Friday from 4-7 PM at: www.Washburn-McReavy.com Northeast Chapel 612-781-6828 2901 Johnson St. N.E.

Peterson, Carl A. age 96, lifetime resident of NE Mpls, passed away peacefully surrounded by family on Sunday, July 27, 2014. Preceded in death by parents, Carl & Anna and brother, Harry. Survived by Alice, his loving wife of 67 years; daugh ter, Ruth (Rev. Gary) Moen; sons, Carl (Carol), Mark, David (Margy), and James; grandchildren, Heather (Byron) Gerard, Elizabeth (Matt) Mekelburg, Jonathan (Kendall) Moen, Ben (Holly), Joey (Candice), Jeff (Betsy), Emma, Abram, and Izaak; great-grandchildren, Caleb, Kaitlyn, Sarah, Emily, Jacob, Micah, Grace, Reid, Annabel and Evelyn; sister, Mae Bergstrom. Also survived by many nieces & nephews, other family and friends. Served with commendations in the Minneapolis Police Dept. He was a Sergeant with the Army Air Corps during WWII and a builder of many fine homes in the metro area. In lieu of flowers, memorials preferred to Elim Church, where he was a lifetime, faithful member. Interment with military honors, Sunset Cemetery. Funeral service Saturday, Aug. 2, 10:30 AM, with visitation one hour before at Elim Church, 685 13th Ave NE. Visitation also Friday from 4-7 PM at: www.Washburn-McReavy.com Northeast Chapel 612-781-6828 2901 Johnson St. N.E. The January Jobs Report showed that 257,000 jobs were created, above the 235,000 expected, as the sector continues to produce robust gains. In addition, job creations for November and December were revised sharply higher by 147,000. The last three months have averaged 336,000 new hires, the best three-month period in the last 17 years. January marked the 11th straight month of job gains above 200,000, the longest streak since 1994.

The January Jobs Report showed that 257,000 jobs were created, above the 235,000 expected, as the sector continues to produce robust gains. In addition, job creations for November and December were revised sharply higher by 147,000. The last three months have averaged 336,000 new hires, the best three-month period in the last 17 years. January marked the 11th straight month of job gains above 200,000, the longest streak since 1994. The first reading of Gross Domestic Product (GDP) for the fourth quarter of 2014 fell to 2.6 percent from the 5 percent recorded in the third quarter. For all of 2014, GDP grew by 2.4 percent, just slightly above the 2.2 percent in 2013. GDP is considered the broadest measure of U.S. economic activity, and strong GDP is an essential sign of our economic recovery. Also of note, Durable Goods Orders (i.e., orders for items that last for an extended period of time) fell by 3.4 percent in December, while November’s numbers were revised lower. These reports show that the U.S. economy continues to muddle along after a six year recovery.

The first reading of Gross Domestic Product (GDP) for the fourth quarter of 2014 fell to 2.6 percent from the 5 percent recorded in the third quarter. For all of 2014, GDP grew by 2.4 percent, just slightly above the 2.2 percent in 2013. GDP is considered the broadest measure of U.S. economic activity, and strong GDP is an essential sign of our economic recovery. Also of note, Durable Goods Orders (i.e., orders for items that last for an extended period of time) fell by 3.4 percent in December, while November’s numbers were revised lower. These reports show that the U.S. economy continues to muddle along after a six year recovery.

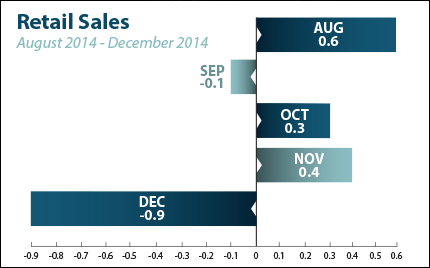

Retail Sales plunged by 0.9 percent in December, the biggest decline in nearly a year as lower gas prices didn’t have the desired impact on consumer spending during the busy shopping season. November’s numbers were also revised lower. This news was a bit of a surprise, and not the best sign for our overall economic recovery. But one number doesn’t make a trend, so this will be an important report to watch in the coming months.

Retail Sales plunged by 0.9 percent in December, the biggest decline in nearly a year as lower gas prices didn’t have the desired impact on consumer spending during the busy shopping season. November’s numbers were also revised lower. This news was a bit of a surprise, and not the best sign for our overall economic recovery. But one number doesn’t make a trend, so this will be an important report to watch in the coming months. The final reading for Gross Domestic Product (GDP) for the third quarter of 2014 came in at a blistering 5.0 percent, the fastest pace of economic growth since the third quarter of 2003. The big gains were led by a surge in both consumer and business spending. GDP is considered the broadest measure of economic activity, so this is a strong sign for our economy heading into the new year.

The final reading for Gross Domestic Product (GDP) for the third quarter of 2014 came in at a blistering 5.0 percent, the fastest pace of economic growth since the third quarter of 2003. The big gains were led by a surge in both consumer and business spending. GDP is considered the broadest measure of economic activity, so this is a strong sign for our economy heading into the new year.