LaDuke, James T. Age 68, of Elk River, passed away on Feb 28, 2015. Veteran of the US Army, US Marines, and National Guard. Retired Minneapolis and Elk River Police Officer, serving his community over 23 years. Preceded in death by his parents; grandson, Nicholas Roche-ford. Survived by his wife of 47 years, Carol; children, Jennifer (Scott) Pulkrabek, Michael (Karen), Rochelle (Mike Weiden) LaDuke, Jamie (Bryan) Rocheford; grandchildren, Dan, Jacob, Sarah, Abigail, and Steven; brother, Rick (Lynde); other family and many friends. Mass of Christian Burial will be at 1 PM Fri., Mar 6 at The Church of St Andrew (763-441-1483), 566-4th St NW, Elk River, with visitation 1 hour prior to service. Visitation also on Thur., Mar 5 from 5-8 PM at Dare’s Funeral Home, 805 Main St, Elk River. In lieu of flowers, consider making a donation to the Joshua Frase Foundation or Wishes & More. 763-441-1212 www.daresfuneralservice.com

LaDuke, James T. Age 68, of Elk River, passed away on Feb 28, 2015. Veteran of the US Army, US Marines, and National Guard. Retired Minneapolis and Elk River Police Officer, serving his community over 23 years. Preceded in death by his parents; grandson, Nicholas Roche-ford. Survived by his wife of 47 years, Carol; children, Jennifer (Scott) Pulkrabek, Michael (Karen), Rochelle (Mike Weiden) LaDuke, Jamie (Bryan) Rocheford; grandchildren, Dan, Jacob, Sarah, Abigail, and Steven; brother, Rick (Lynde); other family and many friends. Mass of Christian Burial will be at 1 PM Fri., Mar 6 at The Church of St Andrew (763-441-1483), 566-4th St NW, Elk River, with visitation 1 hour prior to service. Visitation also on Thur., Mar 5 from 5-8 PM at Dare’s Funeral Home, 805 Main St, Elk River. In lieu of flowers, consider making a donation to the Joshua Frase Foundation or Wishes & More. 763-441-1212 www.daresfuneralservice.com

Published on March 4, 2015

https://www.startribune.com/obituaries/detail/67994/?fullname=james-t-laduke

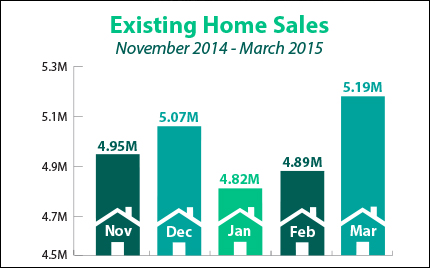

Existing Home Sales in March surged by 6.1 percent from February to an annual rate of 5.19 million units. This was the largest monthly increase since December 2010. Sales are also up 10.4 percent from a year ago. Lawrence Yun, the National Association of REALTORS® chief economist, noted, “After a quiet start to the year, sales activity picked up greatly throughout the country in March.”

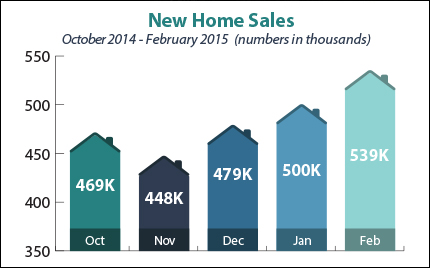

Existing Home Sales in March surged by 6.1 percent from February to an annual rate of 5.19 million units. This was the largest monthly increase since December 2010. Sales are also up 10.4 percent from a year ago. Lawrence Yun, the National Association of REALTORS® chief economist, noted, “After a quiet start to the year, sales activity picked up greatly throughout the country in March.” New Home Sales surged in February, rising 8 percent from January to an annual rate of 539,000 units, while January’s sales were revised higher to 500,000. New Home Sales now stand at their best level since February 2008 and are up nearly 25 percent from the 432,000 recorded in February 2014. The report also showed that the median sales price for new homes was $275,500, up 2.6 percent from a year ago.

New Home Sales surged in February, rising 8 percent from January to an annual rate of 539,000 units, while January’s sales were revised higher to 500,000. New Home Sales now stand at their best level since February 2008 and are up nearly 25 percent from the 432,000 recorded in February 2014. The report also showed that the median sales price for new homes was $275,500, up 2.6 percent from a year ago.

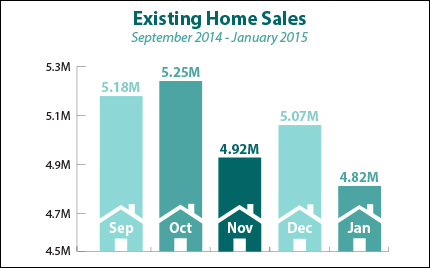

Existing Home Sales slipped in January, coming in below expectations. The annual rate of 4.82 million units was the lowest level since last April as tight inventories, seasonal weather and the ongoing rise in prices kept buyers out of the market. Despite the decline, sales are up by 3.2 percent from a year ago. And while New Home Sales in January were flat, the overall pace of sales hovers near a six-year high as the economy and job market continue to improve. Sales of new homes are up a solid 5.3 percent from a year ago.

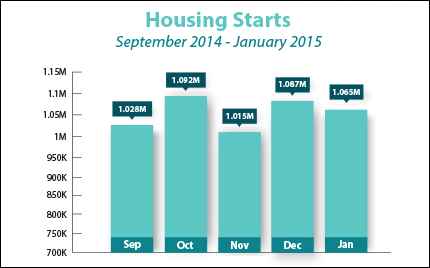

Existing Home Sales slipped in January, coming in below expectations. The annual rate of 4.82 million units was the lowest level since last April as tight inventories, seasonal weather and the ongoing rise in prices kept buyers out of the market. Despite the decline, sales are up by 3.2 percent from a year ago. And while New Home Sales in January were flat, the overall pace of sales hovers near a six-year high as the economy and job market continue to improve. Sales of new homes are up a solid 5.3 percent from a year ago. January Housing Starts fell by 2 percent from December to an annual rate of 1.065 million units. The weaker than expected numbers were due in part to a big decline in single-family homes, as student debt, tight credit conditions and rising prices have kept some first-time homebuyers from entering the market.

January Housing Starts fell by 2 percent from December to an annual rate of 1.065 million units. The weaker than expected numbers were due in part to a big decline in single-family homes, as student debt, tight credit conditions and rising prices have kept some first-time homebuyers from entering the market. Miller, Gordon J., Jr. Age 79, of St. Louis Park. Born August 1935. Passed away on December 29th, 2014. Retired 30 year Minneapolis Police Officer, Detective Lieutenant, Veteran U.S. Army; Korea, Lifetime member NRA, LEAA, Minneapolis Police Retirement Association, FOP. Graduate of Mpls Southwest High School. Gordy was proud to be a husband, father and grandfather. He enjoyed life, seeing his kids grow up, especially watching his boys play hockey. Survived by loving wife of 50 years, Maryann (nee Kosmoski); daughter, Lora Seery (husband John); sons, Jeff (wife Gea) and Matt; along with grandchildren Jordan, Hudson, and Hazel. Interment will be at a later date at Ft. Snelling National Cemetery. Visitation 3-5 pm Sunday, January 4 at: www.Washburn-McReavy.com Edina Chapel 952-920-3996 Hwy 100 at West 50th St., Edina

Miller, Gordon J., Jr. Age 79, of St. Louis Park. Born August 1935. Passed away on December 29th, 2014. Retired 30 year Minneapolis Police Officer, Detective Lieutenant, Veteran U.S. Army; Korea, Lifetime member NRA, LEAA, Minneapolis Police Retirement Association, FOP. Graduate of Mpls Southwest High School. Gordy was proud to be a husband, father and grandfather. He enjoyed life, seeing his kids grow up, especially watching his boys play hockey. Survived by loving wife of 50 years, Maryann (nee Kosmoski); daughter, Lora Seery (husband John); sons, Jeff (wife Gea) and Matt; along with grandchildren Jordan, Hudson, and Hazel. Interment will be at a later date at Ft. Snelling National Cemetery. Visitation 3-5 pm Sunday, January 4 at: www.Washburn-McReavy.com Edina Chapel 952-920-3996 Hwy 100 at West 50th St., Edina Carlson, Robert J. 93 of Mound. Passed away peacefully surrounded by family on Dec. 13. 2014 at Hillcrest of Wayzata. Though it was a gloomy day, the sun came out briefly to usher him home. Preceded in death by his wife Genevieve, son James, sisters Susie Shultz and Elsie Wipper-Granlund. Survived by children Richard (Carole) Carlson, John (Debbie) Carlson, Wendie Carlson and Peter (Suzy) Carlson; grand-children Mark, Stefaney, Lonaiah, Lyndsay, Shaynah, Katie and C.J.; 14 great-grandchildren; and companion Rita Johnson. Bob was a devoted Lutheran, animal lover and was loved by many friends, neighbors and family members. In his final months, he charmed and thanked each caregiver, winning the hearts of many. Memorial service at 11 AM, Thursday, Dec. 18, 2014 at St. John’s Lutheran Church, 2451 Fairview Lane, Mound. Visitation, from 5 to 8 PM, Wednesday, Dec. 17 at the Huber Funeral Home, 1801 Commerce Blvd., Mound and one hour prior to the service on Thursday from 10 to 11 AM at the church. Private family interment at Lakewood Cemetery. In lieu of flowers memorials are preferred to your local Humane Society or SPCA. Huber Funeral & Cremation Services Mound Chapel 952-472-1716 www.huberfunerals.com

Carlson, Robert J. 93 of Mound. Passed away peacefully surrounded by family on Dec. 13. 2014 at Hillcrest of Wayzata. Though it was a gloomy day, the sun came out briefly to usher him home. Preceded in death by his wife Genevieve, son James, sisters Susie Shultz and Elsie Wipper-Granlund. Survived by children Richard (Carole) Carlson, John (Debbie) Carlson, Wendie Carlson and Peter (Suzy) Carlson; grand-children Mark, Stefaney, Lonaiah, Lyndsay, Shaynah, Katie and C.J.; 14 great-grandchildren; and companion Rita Johnson. Bob was a devoted Lutheran, animal lover and was loved by many friends, neighbors and family members. In his final months, he charmed and thanked each caregiver, winning the hearts of many. Memorial service at 11 AM, Thursday, Dec. 18, 2014 at St. John’s Lutheran Church, 2451 Fairview Lane, Mound. Visitation, from 5 to 8 PM, Wednesday, Dec. 17 at the Huber Funeral Home, 1801 Commerce Blvd., Mound and one hour prior to the service on Thursday from 10 to 11 AM at the church. Private family interment at Lakewood Cemetery. In lieu of flowers memorials are preferred to your local Humane Society or SPCA. Huber Funeral & Cremation Services Mound Chapel 952-472-1716 www.huberfunerals.com