Rates Tick Up on Fed Comments

Central banks around the world have had a heavy influence on mortgage rates recently. In the previous weeks, the European Central Bank’s (ECB) plan to expand its bond buying program had a favorable effect, while China’s policy changes had an offsetting effect. This week, it was the U.S. Fed. Even though many recent economic reports in the U.S. contained signs of a slowing economy, the Fed statement explicitly kept the door open for a federal funds rate hike at its December meeting. The hawkish tone surprised investors and caused an unfavorable reaction in mortgage rates.

US Gross Domestic Product numbers were down slightly, however the weakness in the third quarter was mostly due to changes in inventories. A decline in inventories offset 1.4% of growth during the third quarter, meaning that GDP would have increased nearly 3.0% if inventory levels had simply held steady. Similar to last year, GDP growth has averaged a reasonable 2.0% this year, and may be further consideration for a Fed rate bump in December.

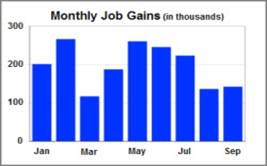

Week Ahead: The important monthly Employment report will be released on Friday. As usual, this data on the number of jobs, the unemployment rate, and wage inflation will be the most highly anticipated economic data of the month. With a possible rate hike in December, there might be a larger than usual reaction to incoming economic data.

Volatility: Moderate

Trend: Higher

Today’s rate snapshot: 30-day lock rates as of 11/02/2015 8:50AM:

30-year Fixed (conforming): 3.875% (3.99%APR*) .125 higher thank last week

15-year fixed (conforming): 3.125% (3.25% APR*) .125 higher thank last week

7-year ARM (conforming) 3.375% (3.49% APR*) .125 higher thank last week

30-year Fixed (jumbo) 3.875% (3.99% APR**) .125 higher thank last week

*Based on 70% LTV, primary residence, rate and term refinance and purchase, 175k minimum loan size, 30-day lock. Rates subject to change at any time based on bond market pricing fluctuations. **Minimum loan size for a jumbo loan is $418,000. This information is intended for professional reference only, and not intended for consumer use. Additional qualifications and disclosures apply.

Have a great week!

Jim Krantz

Vice President

NMLS # 761955

Jim.Krantz@TraditionLLC.com

Direct 952.252.4488 / Cell 612.716.9999 / Fax 952.252.4489

Tradition Mortgage LLC

NMLS # 286998

4350 Baker Rd Suite 190 / Minnetonka, MN 55343 / www.TraditionWest.com

Stroshane, Earl Wayne “Barney” 4/11/45-9/29/15, age 70 of Richfield died after a brief battle with lung cancer. Preceded in death by parents Earl (Bud) and Betty and brother Michael Allen Stroshane. Survived by wife of 43 years, Patricia Mae Atkinson; daughter AnnMarie (John) O’Neill; son Brian Andrew Stroshane; Golden grandson and light of his life, Andrew John O’Neill; sisters Rita Ogren, Janice (Paul) Elvin and Linda (Don) Juran; nieces and nephews. Earl was a 1963 graduate of Central High School in Mpls. He served in the U.S. Air Force and was a devoted and loyal employee of the City of Mpls for 46 1/2 years. He served on the Mpls. Police Department for 30 1/2 years, retiring as a Sgt. He worked another 16 years, until his death, as a civilian employee in the Public Works Department. Per Earl’s wishes, private interment at St. Mary’s Cemetery, Mpls. Memorials preferred to the Mpls Police Honor Guard. cremationsocietyofmn.com

Stroshane, Earl Wayne “Barney” 4/11/45-9/29/15, age 70 of Richfield died after a brief battle with lung cancer. Preceded in death by parents Earl (Bud) and Betty and brother Michael Allen Stroshane. Survived by wife of 43 years, Patricia Mae Atkinson; daughter AnnMarie (John) O’Neill; son Brian Andrew Stroshane; Golden grandson and light of his life, Andrew John O’Neill; sisters Rita Ogren, Janice (Paul) Elvin and Linda (Don) Juran; nieces and nephews. Earl was a 1963 graduate of Central High School in Mpls. He served in the U.S. Air Force and was a devoted and loyal employee of the City of Mpls for 46 1/2 years. He served on the Mpls. Police Department for 30 1/2 years, retiring as a Sgt. He worked another 16 years, until his death, as a civilian employee in the Public Works Department. Per Earl’s wishes, private interment at St. Mary’s Cemetery, Mpls. Memorials preferred to the Mpls Police Honor Guard. cremationsocietyofmn.com Lang, Glen John age 78, of Brainerd, formerly of Columbia Heights, passed away Sept. 2, 2015. Preceded in death by wife, Shirley. Survived by children, John (Jackie), Dawn Walker, Glen Jr. (Becky); grandchildren, Roy, Sydney, Lyndsey and Dewayne; siblings, Dale (Diane), Marion (Virgil) Rasmussen; nieces, nephews, friends and neighbors. Interment Ft. Snelling. Funeral service 11 AM Tuesday, Sept. 8, 2015, with visitation starting one hour prior at: Washburn-McReavy.com Hillside Chapel 612-781-1999 2610 19th Ave NE, Mpls

Lang, Glen John age 78, of Brainerd, formerly of Columbia Heights, passed away Sept. 2, 2015. Preceded in death by wife, Shirley. Survived by children, John (Jackie), Dawn Walker, Glen Jr. (Becky); grandchildren, Roy, Sydney, Lyndsey and Dewayne; siblings, Dale (Diane), Marion (Virgil) Rasmussen; nieces, nephews, friends and neighbors. Interment Ft. Snelling. Funeral service 11 AM Tuesday, Sept. 8, 2015, with visitation starting one hour prior at: Washburn-McReavy.com Hillside Chapel 612-781-1999 2610 19th Ave NE, Mpls